Condo Insurance in and around Fort Collins

Welcome, condo unitowners of Fort Collins

Insure your condo with State Farm today

- Fort Collins

- Larimer County

- Weld County

- Laramie County

- Loveland

- Cheyenne

- Laramie

- LaPorte

- Timnath

- Bellvue

- Windsor

- Longmont

- Wellington

- Severance

- Johnstown

- Greeley

- Eaton

- Ault

- Nunn

- Pierce

- Boulder

- Estes Park

- Berthoud

Home Is Where Your Heart Is

Owning a condo is a lot of responsiblity. You want to make sure your condo and personal property in it are protected in the event of some unexpected mishap or trouble. And you also want to be sure you have liability coverage in case someone stumbles and falls on your property.

Welcome, condo unitowners of Fort Collins

Insure your condo with State Farm today

Why Condo Owners In Fort Collins Choose State Farm

You can sleep soundly with State Farm's Condo Unitowners Insurance knowing you are prepared for the unanticipated with terrific coverage that's right for you. State Farm agent Gwen Brooks can help you understand all the options, from possible discounts, bundling to replacement costs.

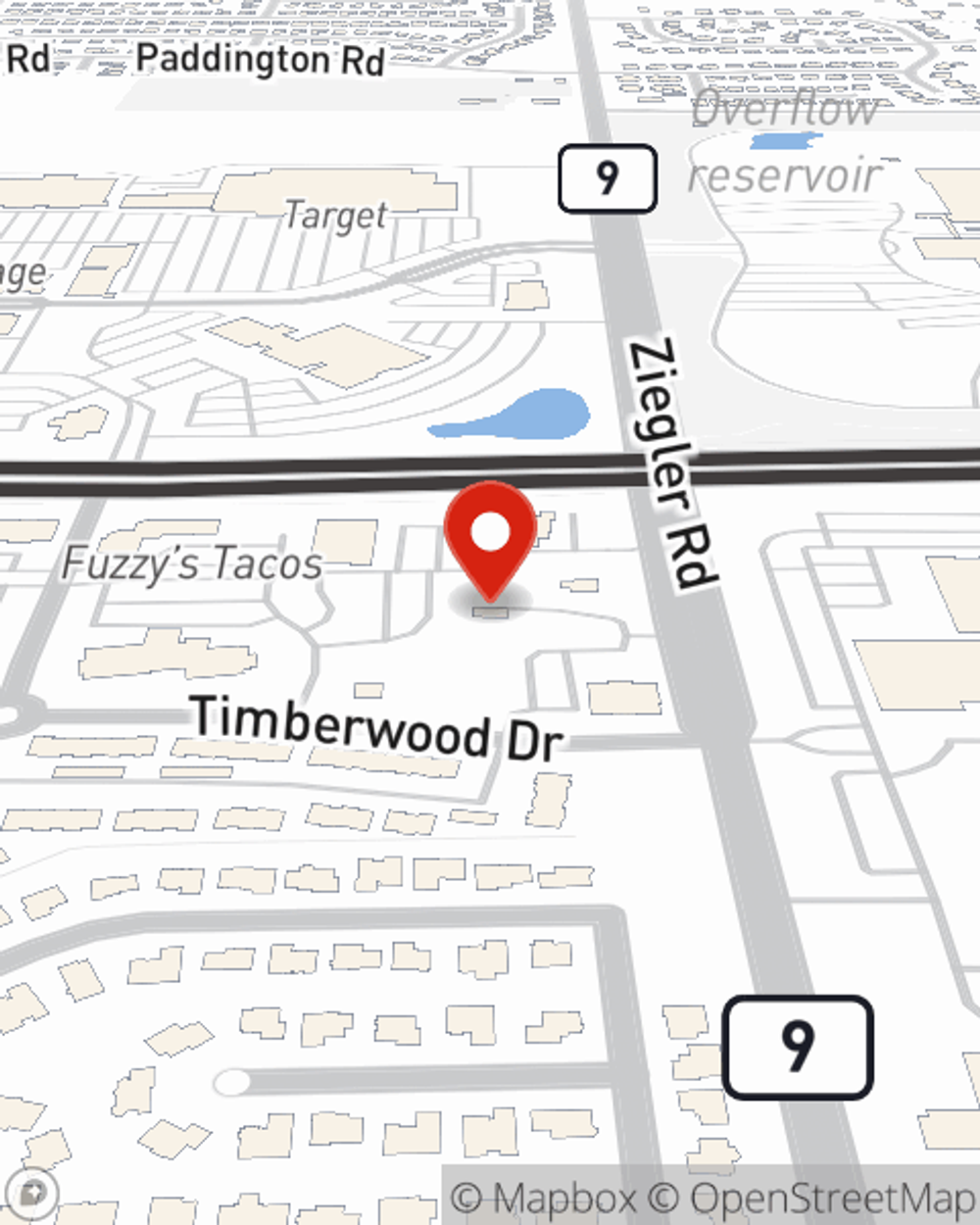

Get in touch with State Farm Agent Gwen Brooks today to learn more about how one of the well known names for condo unitowners insurance can help protect your condo here in Fort Collins, CO.

Have More Questions About Condo Unitowners Insurance?

Call Gwen at (970) 226-1306 or visit our FAQ page.

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Gwen Brooks

State Farm® Insurance AgentSimple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.